You don’t always win when you land on Mayfair.

Mayfair Investment Schemes likely to be a wipe out for Investors

Disclaimer: It is for you to judge whether the following comments apply to your experience with Mayfair. We make no such representation.

Mayfair Wealth Partners Pty Ltd trading as Mayfair Platinum and Mayfair 101 promoted two debenture products to wholesale investors, raising over $140 million dollars.

M Core Fixed Income Notes were marketed as secured promissory notes issued by M101 Nominees Pty and raised $67M from Wholesale Investors.

Mayfair 101’s financial products were pitched to wholesale investors who met one or more of the following criteria:

- have over $2.5 million in net assets, or

- gross income over the past two years of $250,000 or more, or

- invest more than $500,000.

By virtue of their net asset and/or capital position, wholesale investors can also be called sophisticated investors, with the terms often used interchangeably. Despite, however, the connotations associated with the term ‘sophisticated investor’, many of Mayfair’s investors lacked the financial literacy and experience to recognise the significantly higher risk associated with Mayfair’s investment schemes, pouring their superannuation into the products, under the mistaken belief that debentures and unsecured notes were as secure as bank deposits and now have to “live with the consequences that flow from stripped-down investor protections” (Financial Review April 7, 2020).

“These funds may have been marketed as an alternative to term deposits, but they did not benefit from the government guarantee nor from a regulatory regime ensuring depositor funds are sacrosanct. And the investments themselves are not backed by loans such as mortgages, but by speculative venture assets” (Financial Review April 7, 2020).

Mayfair’s online advertising was misleading as “it falsely represented its financial products as equivalent in risk to bank term deposits, in breach of the Corporations Act” (Lawyerly, April 6, 2020).

ASIC alleged that Mayfair misled investors by marketing their fixed income products as an “alternative to bank term deposits” when they were in fact far riskier.

Justice Anderson of the Federal Court agreed, granting an interlocutory injunction to protect consumers from potential harm, which prohibited Mayfair’s use of the following terms “in any [of its] advertising, promotion or marketing”(ASIC v Mayfair [2020] FCA 494):

- “term deposit”;

- “bank deposit”;

- “capital growth”;

- “certainty”;

- “fixed term”; and

- “term investment”

The “certainty” proffered by Mayfair was illusory as Mayfair alone had the capacity to determine if and indeed when it would:

- Make capital and/or interest repayments to investors

- Repay the principal investment upon maturity (Mayfair can extend the time for repayment indefinitely)

- Mayfair was not well-capitalised and was backed by concentrated portfolios of higher risk, unlisted and illiquid assets.

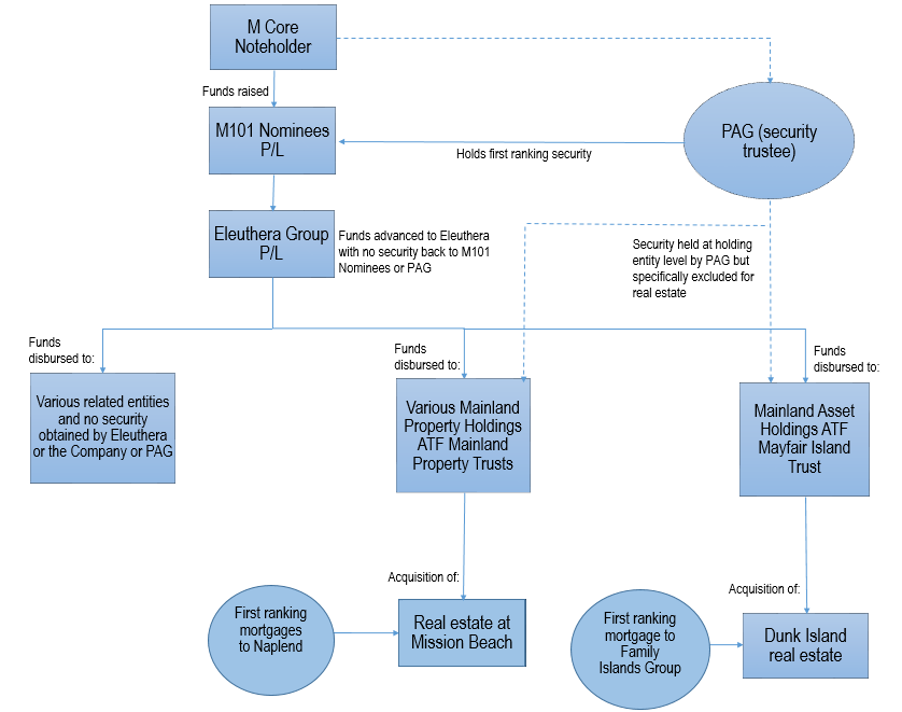

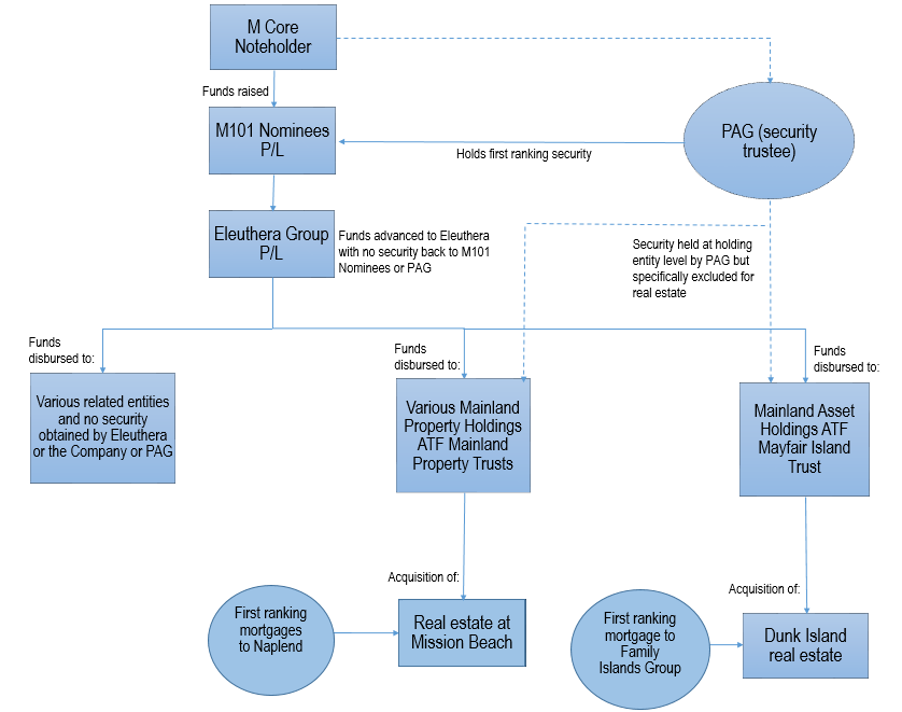

“’M Core’ investment was marketed as a fixed income product backed by dollar-for-dollar asset security” (Grant Thornton 2020, Provisional Liquidators’ Report, Executive Summary, para 1).

“Despite clearly advertising to potential investors that their investment would be supported by ‘first ranking, registered security’ and ‘the assets are otherwise unencumbered’ in my opinion this did not occur. In reality the majority of the funds invested were provided to a related entity, Eleuthera Group Pty Ltd (“Eleuthera Pty Ltd”) on an unsecured loan basis for a term of 10 years at a rate of 8% p.a. The Company did not hold any security over the assets of Eleuthera” (Grant Thornton 2020, Provisional Liquidators’ Report, Executive Summary, para 2).

Mayfair’s investment model was “unsustainable” and insolvent from inception as it involved borrowing on a short-term basis and on-lending on a long-term basis

(Grant Thornton 2020, Provisional Liquidators’ Report, Paragraph 162(c)).

Mayfair’s modus operandi:

“The Company would raise funds at a cost of between 2.65% p.a. to 3.95% p.a. and with the term of 6 to 60 months and then on lend these funds on unsecured 10-year basis to a related entity Eleuthera at 8% per annum. Eleuthera would then either invest or lend those funds either illiquid or non-income producing assets” (Grant Thornton 2020, Provisional Liquidators’ Report, para 30-31).

Compounding Mayfair’s illiquidity was the fact that “the underlying assets were either illiquid and/or non-income producing” (Financial Review September 24, 2020).

Some of the speculative venture assets in which Mayfair invested include: “an Indian accounting firm, the Dunk Island rejuvenation and a superyacht project” (Financial Review April 7, 2020).

Making matters worse was the fact that the underlying, speculative, venture assets were subject to a separate mortgage, “granting investors almost no benefit” (Financial Review September 24, 2020).

The Trustee: PAG Holdings Ltd, trading as PAG

PAG entered into a Security Trust Deed with Mayfair 101 Nominees, the purpose of which was to act on behalf of the security beneficiaries, namely M Core noteholders.

“As part of the investment agreement with M Core noteholders, a Security Trustee was appointed to protect investors’ rights and was responsible for taking security over various related entities/trusts which held assets that were purchased largely from the funds advanced by the Company via Eleuthera” (Grant Thornton 2020, Provisional Liquidators’ Report, Executive Summary, para 3).

In all instances except one, the ‘all present and after-acquired property’ or “ALLPAP” security, excluded real estate, which in turn meant that there was “little to no assets for MCore noteholders given the primary asset of these entities was real estate property” (Grant Thornton 2020, Provisional Liquidators’ Report, Executive Summary, para 2).

“Effectively, PAG had no right to take any security over the real estate assets which were purchased using the M Core noteholder funds. Given the only assets of the trusts were real estate property, it is implausible that the security provided to PAG excluded real estate assets. This may create a scenario that any unsecured creditors of the trusts may also have a competing claim with that of the Security Trustee on behalf of the M Core noteholders” (Grant Thornton 2020, Provisional Liquidators’ Report, para 41).

“Any claims the Director has made to investors or potential investors regarding M Core noteholder funds being secured may be deceptive and misleading on the basis that investor funds are not supported by first-ranking, unencumbered asset security or alternatively what security was granted, had negligible value.” (Grant Thornton 2020, Provisional Liquidators’ Report, para 43).

“It is my opinion that the properties owned by these entities are overvalued for the purpose of reporting to the Security Trustee. Further, as the unit trusts are subject to Receivership and MIP proceedings, the Receivers and MIP costs in dealing with these assets will have to be met from any sale proceeds” (Grant Thornton 2020, Provisional Liquidators’ Report, para 45(a)).

KordaMentha’s refusal to act as receiver

PAG’s failure to adequately protect noteholders, resulted in KordaMentha’s refusal to act as Controller (receiver and manager over the security that the Trustee holds for Noteholder) citing the following concerns:

- The perceived commercial risk associated with an appointment in the absence of the Trustee providing KordaMentha with funding and/or personal indemnities.

- “The significantly reduced value of properties in Northern Queensland and the fact that NAPLA [(being a third-party lender (see Buckley, [105] and Annexure “DB15” to the Buckley affidavit))] holds mortgages on all bar one of the underlying properties and holds a second ranking [all present and after-acquired property (ALLPAAP)] to the Security Trustee (such that his appointment as a receiver and manager may trigger NAPLA to exercise its rights in relation to the security it holds leaving no net equity in the security held by our client’s under the Security Trust Deed)” (ASIC v M101 Nominees [2020] FCA 1166).

ASIC’s wind-up proceedings

ASIC’s wind-up proceedings are currently listed for Hearing before Justice Anderson at the Federal Court of Australia on 15 February 2021. Pending the outcome of these proceedings, Mayfair has been prohibited from taking any fresh investments into M+ Fixed Income Notes and/or M Core Fixed Income Notes.

There is also an interim order in place, restraining Mawhinney, and any company of which he is an officer or shareholder, from the following activities:

- receiving or soliciting funds in connection with any financial product;

- advertising or promoting any financial product; and

- removing from Australia any assets acquired with funds received in connection with any financial product.

Potential Action against Mayfair

Almost as a rule, investors and unsecured creditors will be lucky if they ever see another dime in the event their investments go poorly. Finding a defendant with accessible and sufficient capital is more than half the battle. You cannot expect to get back everything you have lost but there is art in achieving a rewarding settlement – in or out of court – or a judgment through the courts.

Few lawyers in Australia have had more experience in such cases than Levitt Robinson.

Levitt Robinson was behind the Storm Financial-related cases against the banks (CBA, Macquarie, Westpac and BoQ), in which ASIC’s intervention also came too late.

As an investor in M Core or Mayfair Platinum, we understand that you may have been misled into placing your faith and money in either or both of those financial products and, as a result, may have suffered the significant loss of your hard-earned savings and urge you to register your details in potential class action with Class PR.

You don’t always win when you land on Mayfair.

Mayfair Investment Schemes likely to be a wipe out for Investors

Disclaimer: It is for you to judge whether the following comments apply to your experience with Mayfair. We make no such representation.

Mayfair Wealth Partners Pty Ltd trading as Mayfair Platinum and Mayfair 101 promoted two debenture products to wholesale investors, raising over $140 million dollars.

M Core Fixed Income Notes were marketed as secured promissory notes issued by M101 Nominees Pty and raised $67M from Wholesale Investors.

Mayfair 101’s financial products were pitched to wholesale investors who met one or more of the following criteria:

- have over $2.5 million in net assets, or

- gross income over the past two years of $250,000 or more, or

- invest more than $500,000.

By virtue of their net asset and/or capital position, wholesale investors can also be called sophisticated investors, with the terms often used interchangeably. Despite, however, the connotations associated with the term ‘sophisticated investor’, many of Mayfair’s investors lacked the financial literacy and experience to recognise the significantly higher risk associated with Mayfair’s investment schemes, pouring their superannuation into the products, under the mistaken belief that debentures and unsecured notes were as secure as bank deposits and now have to “live with the consequences that flow from stripped-down investor protections” (Financial Review April 7, 2020).

“These funds may have been marketed as an alternative to term deposits, but they did not benefit from the government guarantee nor from a regulatory regime ensuring depositor funds are sacrosanct. And the investments themselves are not backed by loans such as mortgages, but by speculative venture assets” (Financial Review April 7, 2020).

Mayfair’s online advertising was misleading as “it falsely represented its financial products as equivalent in risk to bank term deposits, in breach of the Corporations Act” (Lawyerly, April 6, 2020).

ASIC alleged that Mayfair misled investors by marketing their fixed income products as an “alternative to bank term deposits” when they were in fact far riskier.

Justice Anderson of the Federal Court agreed, granting an interlocutory injunction to protect consumers from potential harm, which prohibited Mayfair’s use of the following terms “in any [of its] advertising, promotion or marketing”(ASIC v Mayfair [2020] FCA 494):

- “term deposit”;

- “bank deposit”;

- “capital growth”;

- “certainty”;

- “fixed term”; and

- “term investment”

The “certainty” proffered by Mayfair was illusory as Mayfair alone had the capacity to determine if and indeed when it would:

- Make capital and/or interest repayments to investors

- Repay the principal investment upon maturity (Mayfair can extend the time for repayment indefinitely)

- Mayfair was not well-capitalised and was backed by concentrated portfolios of higher risk, unlisted and illiquid assets.

“’M Core’ investment was marketed as a fixed income product backed by dollar-for-dollar asset security” (Grant Thornton 2020, Provisional Liquidators’ Report, Executive Summary, para 1).

“Despite clearly advertising to potential investors that their investment would be supported by ‘first ranking, registered security’ and ‘the assets are otherwise unencumbered’ in my opinion this did not occur. In reality the majority of the funds invested were provided to a related entity, Eleuthera Group Pty Ltd (“Eleuthera Pty Ltd”) on an unsecured loan basis for a term of 10 years at a rate of 8% p.a. The Company did not hold any security over the assets of Eleuthera” (Grant Thornton 2020, Provisional Liquidators’ Report, Executive Summary, para 2).

Mayfair’s investment model was “unsustainable” and insolvent from inception as it involved borrowing on a short-term basis and on-lending on a long-term basis

(Grant Thornton 2020, Provisional Liquidators’ Report, Paragraph 162(c)).

Mayfair’s modus operandi:

“The Company would raise funds at a cost of between 2.65% p.a. to 3.95% p.a. and with the term of 6 to 60 months and then on lend these funds on unsecured 10-year basis to a related entity Eleuthera at 8% per annum. Eleuthera would then either invest or lend those funds either illiquid or non-income producing assets” (Grant Thornton 2020, Provisional Liquidators’ Report, para 30-31).

Compounding Mayfair’s illiquidity was the fact that “the underlying assets were either illiquid and/or non-income producing” (Financial Review September 24, 2020).

Some of the speculative venture assets in which Mayfair invested include: “an Indian accounting firm, the Dunk Island rejuvenation and a superyacht project” (Financial Review April 7, 2020).

Making matters worse was the fact that the underlying, speculative, venture assets were subject to a separate mortgage, “granting investors almost no benefit” (Financial Review September 24, 2020).

The Trustee: PAG Holdings Ltd, trading as PAG

PAG entered into a Security Trust Deed with Mayfair 101 Nominees, the purpose of which was to act on behalf of the security beneficiaries, namely M Core noteholders.

“As part of the investment agreement with M Core noteholders, a Security Trustee was appointed to protect investors’ rights and was responsible for taking security over various related entities/trusts which held assets that were purchased largely from the funds advanced by the Company via Eleuthera” (Grant Thornton 2020, Provisional Liquidators’ Report, Executive Summary, para 3).

In all instances except one, the ‘all present and after-acquired property’ or “ALLPAP” security, excluded real estate, which in turn meant that there was “little to no assets for MCore noteholders given the primary asset of these entities was real estate property” (Grant Thornton 2020, Provisional Liquidators’ Report, Executive Summary, para 2).

“Effectively, PAG had no right to take any security over the real estate assets which were purchased using the M Core noteholder funds. Given the only assets of the trusts were real estate property, it is implausible that the security provided to PAG excluded real estate assets. This may create a scenario that any unsecured creditors of the trusts may also have a competing claim with that of the Security Trustee on behalf of the M Core noteholders” (Grant Thornton 2020, Provisional Liquidators’ Report, para 41).

“Any claims the Director has made to investors or potential investors regarding M Core noteholder funds being secured may be deceptive and misleading on the basis that investor funds are not supported by first-ranking, unencumbered asset security or alternatively what security was granted, had negligible value.” (Grant Thornton 2020, Provisional Liquidators’ Report, para 43).

“It is my opinion that the properties owned by these entities are overvalued for the purpose of reporting to the Security Trustee. Further, as the unit trusts are subject to Receivership and MIP proceedings, the Receivers and MIP costs in dealing with these assets will have to be met from any sale proceeds” (Grant Thornton 2020, Provisional Liquidators’ Report, para 45(a)).

KordaMentha’s refusal to act as receiver

PAG’s failure to adequately protect noteholders, resulted in KordaMentha’s refusal to act as Controller (receiver and manager over the security that the Trustee holds for Noteholder) citing the following concerns:

- The perceived commercial risk associated with an appointment in the absence of the Trustee providing KordaMentha with funding and/or personal indemnities.

- “The significantly reduced value of properties in Northern Queensland and the fact that NAPLA [(being a third-party lender (see Buckley, [105] and Annexure “DB15” to the Buckley affidavit))] holds mortgages on all bar one of the underlying properties and holds a second ranking [all present and after-acquired property (ALLPAAP)] to the Security Trustee (such that his appointment as a receiver and manager may trigger NAPLA to exercise its rights in relation to the security it holds leaving no net equity in the security held by our client’s under the Security Trust Deed)” (ASIC v M101 Nominees [2020] FCA 1166).

ASIC’s wind-up proceedings

ASIC’s wind-up proceedings are currently listed for Hearing before Justice Anderson at the Federal Court of Australia on 15 February 2021. Pending the outcome of these proceedings, Mayfair has been prohibited from taking any fresh investments into M+ Fixed Income Notes and/or M Core Fixed Income Notes.

There is also an interim order in place, restraining Mawhinney, and any company of which he is an officer or shareholder, from the following activities:

- receiving or soliciting funds in connection with any financial product;

- advertising or promoting any financial product; and

- removing from Australia any assets acquired with funds received in connection with any financial product.

Potential Action against Mayfair

Almost as a rule, investors and unsecured creditors will be lucky if they ever see another dime in the event their investments go poorly. Finding a defendant with accessible and sufficient capital is more than half the battle. You cannot expect to get back everything you have lost but there is art in achieving a rewarding settlement – in or out of court – or a judgment through the courts.

Few lawyers in Australia have had more experience in such cases than Levitt Robinson.

Levitt Robinson was behind the Storm Financial-related cases against the banks (CBA, Macquarie, Westpac and BoQ), in which ASIC’s intervention also came too late.

As an investor in M Core or Mayfair Platinum, we understand that you may have been misled into placing your faith and money in either or both of those financial products and, as a result, may have suffered the significant loss of your hard-earned savings and urge you to register your details in potential class action with Class PR.